Mustering the courage to grow

By David Poppenbeek February 2018

The start of February saw RBA Governor of the Reserve Bank of Australia (RBA), Mr Philip Lowe, give his first speech for 2018 at the A50 Australian Economic Forum.[1] Among other things, Governor Lowe addressed frequently asked queries from global investors affecting the Australian economy. The most pressing issue seemed to be the duration of Australia’s economic expansion relative to other more mature developed economies. On this issue, Governor Lowe stated that:

“One of the facts that visitors to Australia most frequently remark upon is that Australia has experienced 26 years of economic growth. Over those 26 years we have certainly experienced some slowdowns and periods of rising unemployment but this long record of economic expansion and stability is not matched elsewhere among the advanced economies”

The collective view of global investors at the forum appeared to be that Australia’s economic momentum is fatally challenged. Specifically, should Australia’s economic growth subside, Australia’s high level of household debt would cause an irreversible negative feedback loop. While we share some sympathy for this view, we prefer to believe that Australia is not “ex-growth”. It is our view that Australia’s economic potential has been stifled somewhat by a misconception that Australian banks (ADI) should be “unquestionably strong”, which has led to an inefficient allocation of risk capital. We believe that business leaders can liberate Australia’s economic potential by mustering the courage to grow.

In 2014, Australia conducted an inquiry into whether the country’s financial system met its evolving needs whilst also supporting economic growth (Financial System Inquiry).[2] Originally, we understood the key considerations for the Financial System Inquiry to be: (a) whether the existing financial system settings prevented the economy from operating and allocating funds efficiently; and (b) whether regulation was appropriately calibrated to provide confidence in the financial system whilst allowing technological change, innovation and entrepreneurship. Needless to say, we were surprised to read that the final report recommended that the capital ratios of ADIs should be “unquestionably strong” and should be “ranked in the top 25% of global banks”. Unfortunately, we see some adverse consequences to a gold-plated banking system.

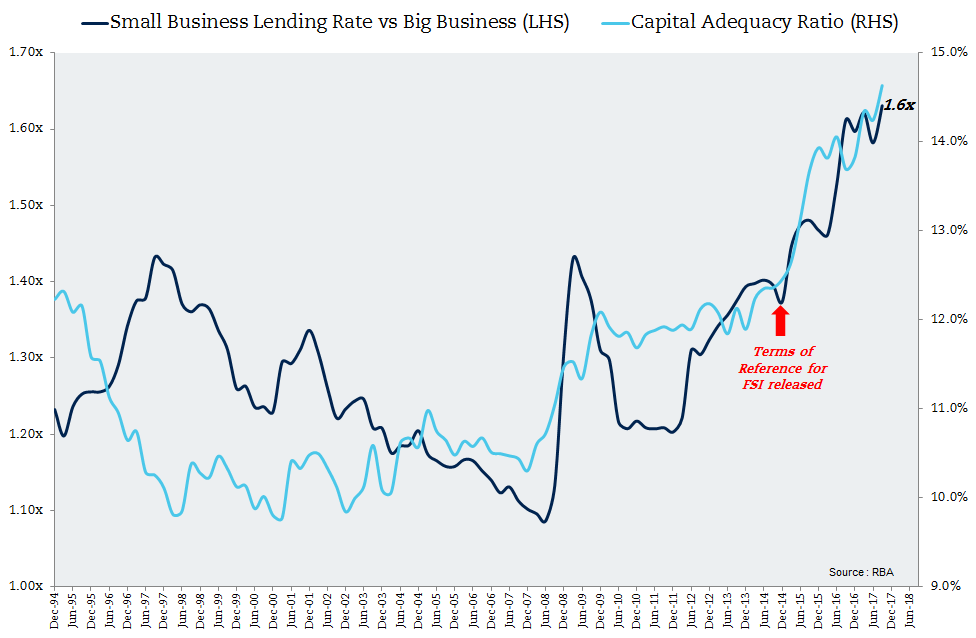

Since the Australian Treasurer announced the final terms of reference for the Financial System Inquiry in December 2013,[3] ADIs collectively inflated their capital base by 45%, prompting the curtailment of lending activities. As a consequence, total bank lending growth slowed to 6.0% p.a. and Australia’s nominal GDP growth dropped to 3.4% p.a. As a comparator, in the 25 years before the Financial System Inquiry, bank loans grew 9.2% p.a. and nominal GDP growth reached 5.9% p.a. Interestingly, since December 2013, the rate of lending growth in the housing and commercial sectors slowed by 35%. However, there has been a significant change in the composition of commercial lending. Lending growth to big businesses is growing more than three times faster than lending to small businesses. To us, this outcome suggests that lending capital has been deployed in risk minimisation strategies, instead of the pursuit of entrepreneurship and risk-taking activities, which we believe are enablers to further economic growth.

Over the past 25 years, Australian businesses with credit outstanding below AU$2 million have endured an average cost of debt 1.3 times greater than the interest rate for business with borrowings above AU$2 million. According to RBA data, the current interest rate for businesses with debt less than AU$2 million is 5.30%, which is 1.6 times the prevailing rate for businesses with borrowings above AU$2 million. We believe that this preferential interest rate has given Australian big business an unprecedented cost of capital advantage, which predates the Financial System Inquiry.

It is our view that this interest rate differential cannot expand any further. We believe that ADIs have now inflated their capital base to levels that significantly reduce moral hazard risks. There is little doubt in our mind that our financial system is “unquestionably strong”, however we do express some doubt as to whether Australia’s economic trajectory has been supported by this unquestionably strong financial system.

Despite the prevailing conditions, it is our view that the Australian small business landscape is adapting to the rationing of bank capital. Remarkably, last year there were more than 250,000 new Australian businesses formed, and there are now over 2.5 million Australian registered companies.[4] Accordingly, we would argue that this integral component of the Australian economy has mustered the courage to grow. By being forced to adjust to prevailing trading conditions, it is apparent to us that Australian small businesses are adopting business models that are less capital intense and more technologically flexible and enabled than their larger established peers. Given that small businesses have also been stress-tested by adverse economic conditions and restrictive costs of doing business, we believe that economic tail-winds could be a powerful force that drives Australia’s fortunes in the years ahead. We believe that as economic strength broadens, ambitious small businesses may look to the listed equity market to fund their next phase of capital growth. We therefore envisage that our Australian funds will be presented with a significant number of IPO opportunities over the coming years.

[1] See Governor Lowe’s address at the A50 Dinner here.

[2] See the Australian Financial System Inquiry Final Report here.

[3] See the Treasurer’s final terms of reference here.

[4] See ASIC company registration statistics here.

DISCLAIMER:

The information contained on this website is produced by K2 Asset Management Limited (K2) ABN 95 085 445 094, AFS Licence No 244393, a wholly owned subsidiary of K2 Asset Management Holdings Limited. Its contents are current to the date of the publication only and whilst all care has been taken in its preparation, K2 accepts no liability for errors or omissions. The application of its contents to specific situations (including case studies and projections) will depend upon each particular circumstance. The contents of this website have been prepared without taking into account the objectives or circumstances of any particular individual or entity and is intended for general information only.

Any opinions contained within this website are the author’s own and should not be considered the opinion of K2 or as advice.

Any K2 funds referenced on this website are issued by K2 unless otherwise stated. A product disclosure statement or information memorandum for the K2 funds referred to on this website can be obtained at www.k2am.com or by contacting K2. You should consider the product disclosure statement before making a decision to acquire an interest in a fund.

K2 does not accept any responsibility and disclaims any liability whatsoever for loss caused to any party by reliance on the information on this website. Please note that past performance is not a reliable indicator of future performance. Any advice and information contained on this website is general only and has been prepared without taking into account any particular circumstances and needs of any party. Before acting on any advice or information on this website you should assess and seek advice on whether it is appropriate for your needs, financial situation and investment objectives. Investment decisions should not be made upon the basis of its past performance or distribution rate, or any rating given by a ratings agency, since each of these can vary. In addition, ratings need to be understood in the context of the full report issued by the ratings agency themselves.

The content of this website is not to be reproduced without permission.